XM Review

- High regulation from CySEC and ASIC.

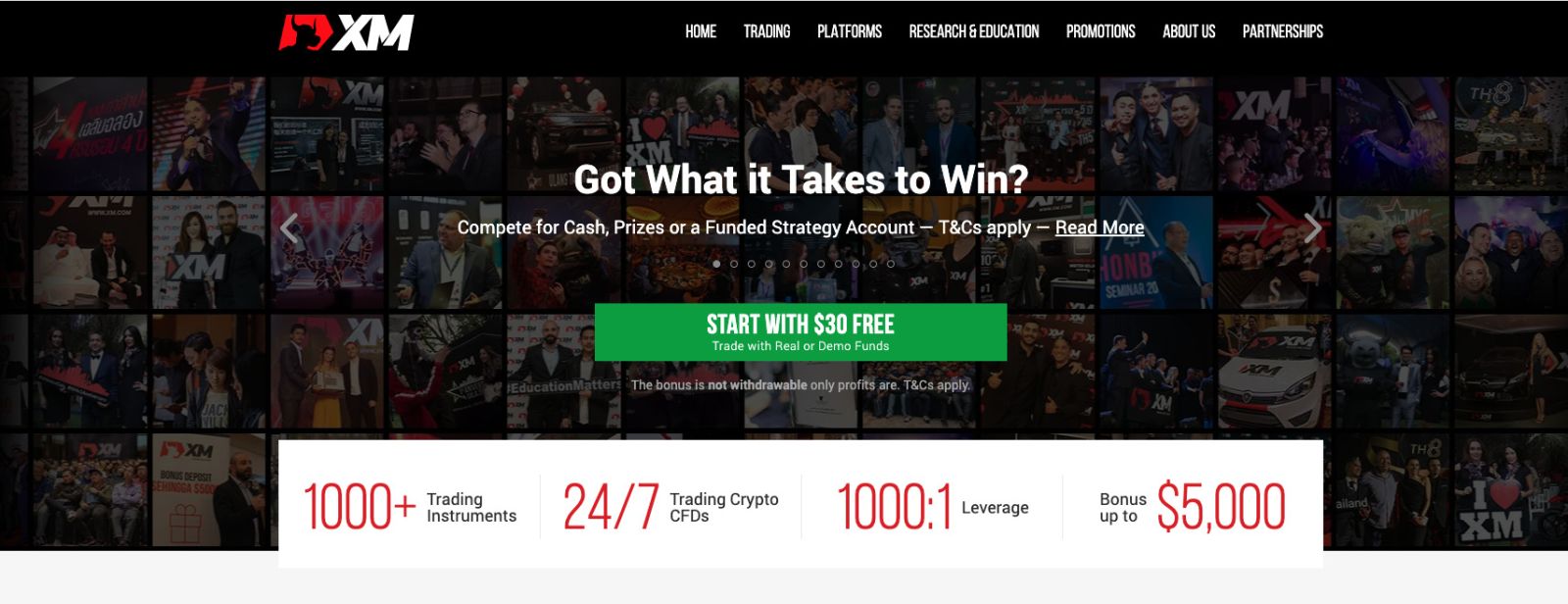

- 1,000+ tradable assets across Forex, Stocks, Indices, Commodities, Metals and Energies.

- Low CFD

- Zero Fees on Deposits and Withdrawals

- Great educational and research service with daily interactive live trading rooms.

- More than 20 languages supported

- Traders from 190 countries

- Free VPS Services

- Platforms: MetaTrader 4, MetaTrader 5

- Platforms: MetaTrader 4, MetaTrader 5

Point Summary

| Headquarters | Belize, Dubai |

| Country of regulation | ESMA, CySEC, ASIC, etc. |

| Platforms | MetaTrader trading software offering MT4 and MT5 platforms |

| Instruments | Stocks, CFDs on Forex, Commodities, Portfolios, Metals |

| Costs | Trading costs and spreads are average compared to competition |

| Demo Account | Available |

| Minimum deposit | 5$ |

| Base currencies | Various currencies supported |

| Leverage | 1:1000 |

| Withdrawal options | Credit Card Bank Transfer Skrill, Neteller, etc |

| Education | Professional Education with vast learning materials, Live webinars and regularly held Seminars |

| Customer Support | 24/7 |

Introduction

XM was first started back in 2009 in Cyprus, so far operating clients from over 190 countries and is among the most trusted Regulated Brokers.

XM is regulated by the FSC Belize and they have European passports with the MiFID, as well as being regulated by the CySEC in Cyprus, as well as being regulated in Australia as an ASIC entity.

They have an offering of more than 400 different instruments, this includes over 350 CFDs, as well as more than 55 currency pairs.

About 1.5 Million Traders and investors at XM choose its wide range of XM trading products and the services broker provides along with advanced trading solutions, yet suitable for beginning traders as well. The reason for such fast growth and trust to the broker is that XM aims to provide one of the best user experience in the industry to its clients.

They offer more than 20 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in Europe in 2018 by the World Finance Magazine.

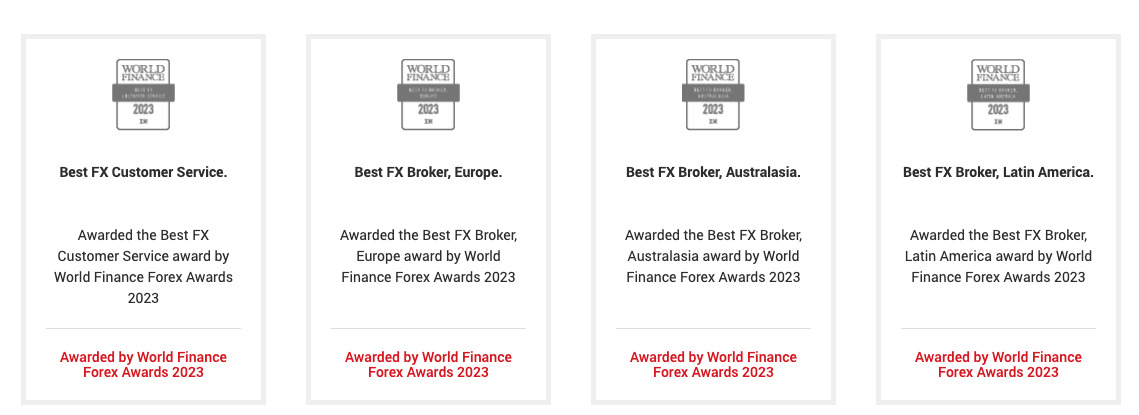

Awards

Overall, XM achieved a great focus on the Client’s needs while offers very competitive conditions and a range of services that attract global traders. Apart from its highly good results and reputation among the trading community, XM received truly global recognition with many reputable awards for industry achievements including Best Forex Broker for Europe, Most Trusted Broker, etc.

Is XM safe or a scam?

The XM broker group of entities stuck to enhanced regulatory standards as the broker is fully compliant with the necessary regulation policies in each jurisdiction it operates. Therefore, Trading Point of Financial Instruments Ltd (XM.com) considered being a safe broker as clients are operated in accordance with the Markets in Financial Instruments Directive (MiFID) of the European Union and follows other regulatory obligations, as well.

Is XM regulated?

XM Group is a group of regulated online brokers, which serves as Trading Point of Financial Instruments Ltd established in 2009 and regulated by the Cyprus Securities and Exchange Commission (CySEC), another entity Trading Point of Financial Instruments was established in 2015 in Australia and is regulated by Australian Securities and Investments Commission (ASIC). So the regulatory obligations are covered at a sustainable level as we see through our XM Review.

In addition, the global operation is enabled by XM global Limited established in 2017 and regulated by the Financial Services Commission, allowing to offer its services across the globe. Despite the fact that FSC is an offshore license, that does not actually implement strict overseeing of the trading processes, yet additional heavy regulation of the XM made it an acceptable choice.

| XM entity | Regulation and License |

| Trading Point of Financial Instruments Ltd | CySEC (Cyprus) registration no 120/10 |

| Trading Point of Financial Instruments Pty Ltd | ASIC (Australia) registration no 443670 |

| Trading Point MENA Limited | Regulated by the Dubai Financial Services Authority (DFSA) Reference No. F003484 |

| XM Global Limited | FSC (Belize) registration no. 000261/397 |

Is XM a reliable broker?

The main idea of the regulation is that the trader can trade secure, knowing that clients funds collaborate according to the strictest rules with minimized risks of fraud or unfair use. XM operates its trading environment according to the regulatory measures making it a reliable broker.

Client funds are kept in investment grade banks and use segregated accounts, also falling under the Investor Compensation Fund that ensures recovery of funds up to €20,000 in case broker goes insolvent (note that the coverage scheme depends on the particular entity - Trading Point of Financial Instruments Ltd). Besides, one of the advantages you will get as a trader is a Negative Balance Protection, so there is no risk to lose more than the available balance.

Accounts

If you are new to trading a demo account is another useful tool to test trading potential which XM is offering for free use.

| Pros | Cons |

|---|---|

|

|

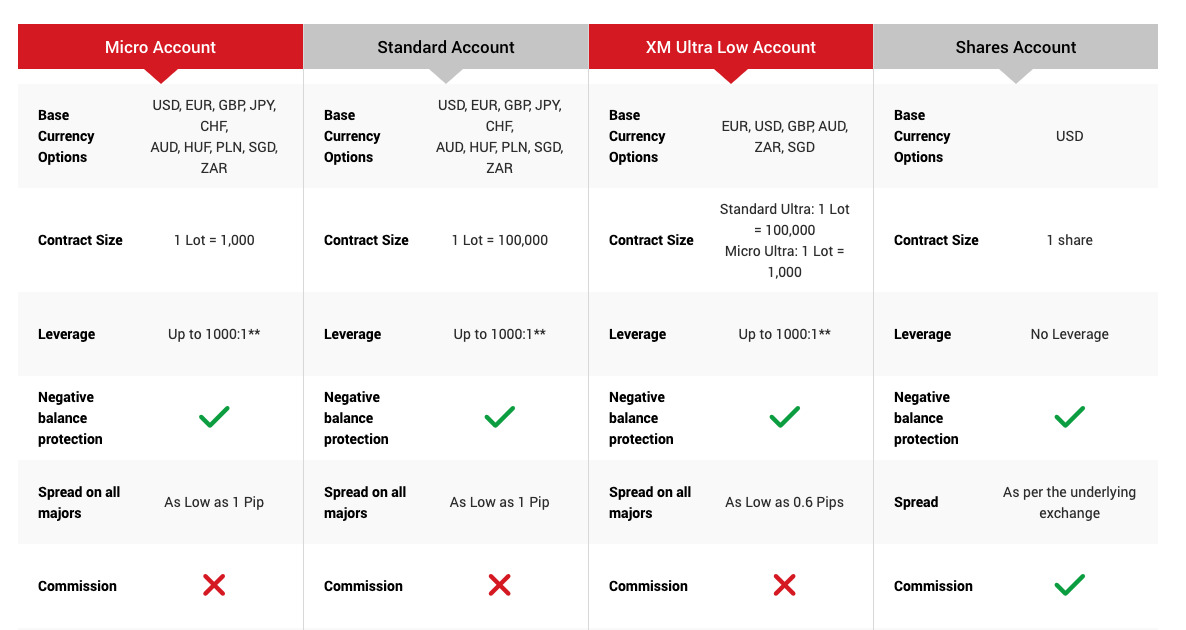

XM Account Types

XM provides four different accounts, each with comprehensive features with the purpose of catering for individual traders despite their trading and financial objectives, these include:

- Micro Account

- Standard Account

- XM Ultra-Low Account, and

- Shares Account

The diversity provided by these account types ensures that traders have access to a trading environment that is competitive yet cost-effective were trading and non-trading costs are concerned while providing traders with the edge they need to facilitate their trading.

XM Demo Account

XM offers traders the option of opening a Demo Account on either the Standard or the XM Ultra-Low Account which can be utilized in various ways, including, but not limited to the following:

- A practice account for beginner traders who wish to improve their trading skills and experience in a risk-free environment using virtual funds.

- Traders who are evaluating and comparing brokers who would like to explore XM’s trading conditions in a risk-free environment, and

- Traders who wish to test their trading strategies in a mimicked live trading environment without risking their capital.

XM’s demo account sign-up is fully digitalized and hassle-free. It can be done within a few minutes and as soon as the trader is registered, demo trading can commence once the MetaTrader 4 or MetaTrader 5 trading platforms have been installed on either

- Desktop PCs that use Linux, Windows, or MacOS, or

- Mobile devices such as tablets and smartphones run Android or iOS operating systems.

Alternatively, traders can easily access the trading platforms from their web browser and use their credentials to sign into their XM Demo Account using either of the trading platforms.

Leverage

At XM clients have the flexibility to trade by using the same margin requirements and leverage from 1:1 to 1000:1.

XM’s margin requirements and leverage are based on the total equity in your account(s) as described below:

| Leverage | Total Equity |

|---|---|

| 1:1 to 1000:1 | $5 — $40,000 |

| 1:1 to 500:1 | $40,001 — $80,000 |

| 1:1 to 200:1 | $80,001 — $200,000 |

| 1:1 to 100:1 | $200,001 + |

Market Instrument

In total, there are more than 1000 different CFDs offered by XM. There are more than 55 currency pairs with a total over 1000+ trading markets on offer and they don’t offer any ETF products.

Trading Platforms

When it comes to trading platforms, XM offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are widely recognized in the industry for their advanced charting capabilities, technical analysis tools, and automated trading features. Traders can access their accounts and trade on these platforms through desktop applications, web browsers, and mobile devices.

- XM MetaTrader 4 (MT4) platform

XM’s MT4 platform stands as a testament to seamless trading execution. Offering a diverse instrument range of over 1000 options, it empowers traders to explore currencies, CFDs, and futures. Traders benefit from unified access to multiple platforms with a single login, competitive spreads as low as 0 pips, and full Expert Advisor (EA) functionality for automated trading.

- XM MetaTrader 4 (MT4) WebTrader

Accessible via web browsers, the MT4 WebTrader enhances convenience. Traders can execute instant orders, conduct real-time analysis, and benefit from account synchronization across different platforms. The platform supports multiple languages, fostering inclusivity.

- XM MetaTrader 5 (MT5) platform

Building on the success of MT4, XM introduces the MT5 platform, boasting over 1000 instruments, including stock CFDs, indices, and precious metals. With unified access to multiple platforms, competitive spreads, and advanced technical analysis tools, MT5 stands as a versatile multi-asset platform.

- XM MetaTrader 5 (MT5) WebTrader

The MT5 WebTrader complements the downloadable version, offering accessibility without software installation. Traders can execute instant orders, access real-time quotes, and synchronize accounts seamlessly across platforms.

- XM mobile trading platforms: MT4 and MT5 apps

Recognizing the importance of mobile trading, XM provides apps for Android and iPhone devices compatible with both MT4 and MT5. Traders enjoy account access, real-time quotes, interactive charts, and account management features, ensuring a comprehensive trading experience.

- XM’s own mobile app

XM’s dedicated mobile app offers unique features, including access to over 1000 instruments, instant order execution with no re-quotes, account customization options, and advanced charts with over 90 indicators. Compatible with both MT4 and MT5, it provides traders with a tailored and flexible mobile trading experience.

In conclusion, XM’s suite of trading platforms caters to the diverse needs of traders, providing advanced features, competitive spreads, and seamless integration across desktop, web, and mobile devices. The commitment to accessibility, convenience, and innovation solidifies XM’s position as a broker dedicated to delivering a holistic and powerful trading experience.

Deposits and Withdrawals

The funds transaction at XM are managed in a customer-oriented way too, traders having a choice of multiple payment methods supported in all countries. Various payment options including commonly used, also XM again took care of clients’ comfort and introduced a local bank transfer option, which enables to fund the account through local banks and currency with no conversion charges.

XM offers a wide range of payment options for deposit/withdrawals:

- Credit/Debit cards, Skrill, Neteller, International bank transfer, Online bank transfer, Perfect money, Apple pay, Google pay, ...

| Pros | Cons |

|---|---|

|

|

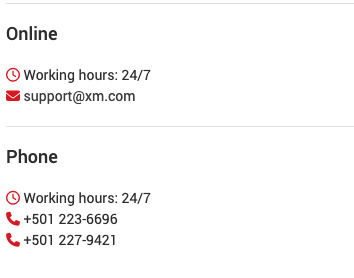

Customer Support

As for the customer support and service, as we see XM globally covers trading needs while the customer service team available in international locations and speaks more than 25 languages including Chinese, Russian, Hindi, Arabic, Portuguese, Thai, Tagalog and more languages.

Customer service available for your concerns and answers either through email, phone or live chat. Also, we found that service is a good quality with reliable answers, which confirms again XM’s client oriented policy.

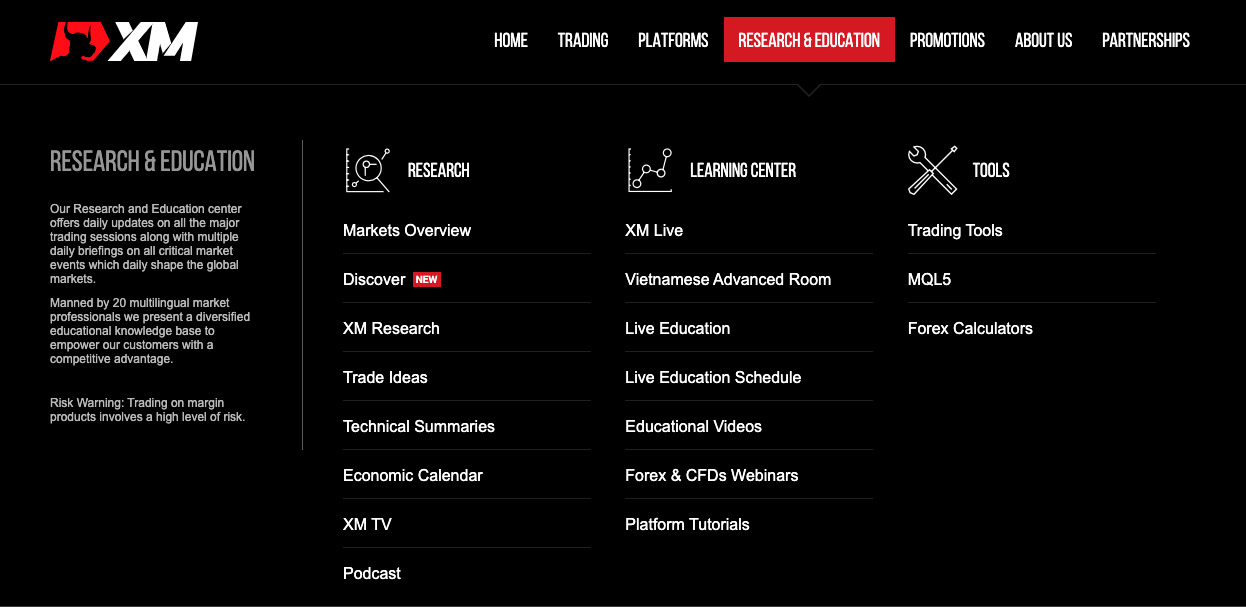

Research Education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Conclusion

Overall, XM is considered a safe, trustworthy broker. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner. XM offers a total of four different account types each consisting of different features to offer.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

XM can be summarily described as a worthwhile company for potential traders, retail traders, experienced traders, or professional traders, knowing that they approach your needs with openness to cultural, national, ethnic, and religious diversity.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.